Elements of Financial System

(i) Mobilization of investment funds: Savings are finished by a huge number of individuals. Be that as it may, sum spared are of no utilization except if they are activated into monetary resources, regardless of whether cash, bank stores, post office investment funds stores, extra security arrangements, common assets, securities or value shares.

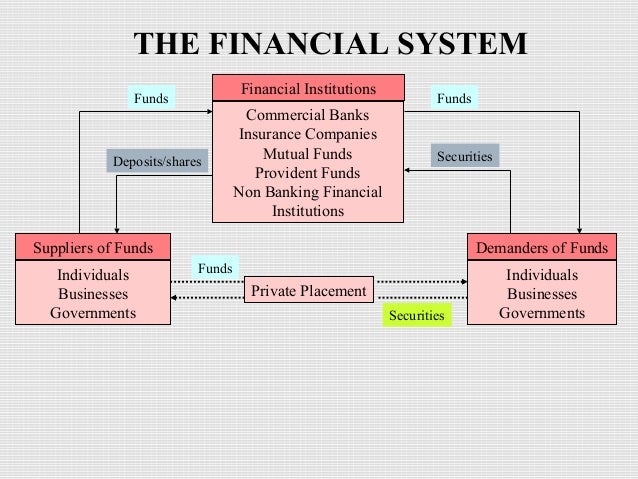

(ii) Allocations of reserve funds : Amount of investment funds activated through a huge number of individuals will at that point be dispensed among the destitute areas. Direct loaning by the overall population has been made conceivable through corporate securities and values. Plus, there are banks, insurance agencies, and other money related organizations. They fill in as monetary go-betweens between a definitive loan specialist and a definitive borrower. They prepare reserve funds of the moneylender by selling their very own liabilities which are stores, protection premium sum and so on and make these assets accessible to destitute borrowers at their very own hazard. Along these lines, numerous savers locate the auxiliary securities (aberrant loaning) of money related foundations substantially more satisfactory than the essential securities (direct loaning) of a wide range of borrowers.

(iii) A money related framework gives an installment framework to the trading of merchandise and enterprises : For trade or closeout of products and ventures, installment in real money is the most favored mode. Be that as it may, huge scale organizations bargain for the most part in credit exchanges. After a specific date, installments are made either through check or online installment.

(iv) A money related framework gives a component to the pooling of assets to put resources into extensive scale endeavors : Large corporates raises assets through securities, debentures and open stores to put resources into expansive scale business undertakings.

(v) Provide installment and settlement framework : Banks give this component by methods for an installment office dependent on checks, promissory notes, credit and platinum cards. The installment instrument is currently being progressively made through electronic methods. The clearing and settlement component of the financial exchange is done through safes and clearing enterprises.

(vi) Monitor corporate execution : A money related framework not just aides in choosing the tasks to be supported yet additionally propels the different partners of the budgetary framework to screen the execution of the speculation. Monetary markets and foundations help to screen corporate execution and apply weight on the corporates to persistently improve their execution.

(vii) Helps in hazard decrease : The monetary framework helps in decrease of hazard in the budgetary framework by setting down standards for example SEBI which sets down standards, guidelines and rules every once in a while for proficient and straightforward lead of tasks in the capital market. Hazard decrease is accomplished by broadening of portfolios and screening of borrowers. Market members additionally shield themselves from surprising possibilities by purchasing protection administrations. Hazard is exchanged the budgetary market through money related instruments, for example, subordinates. The subsidiaries move hazard from the individuals who have it however don't need it to the individuals who are eager to take it.

(viii) Provide cost related data : Financial markets give data which empowers the speculators to settle on an educated choice about whether to purchase, sell or hold a budgetary resource. This data dispersal encourages valuation of budgetary resources. Further, this procedure of valuation impacts the market cost of value and obligation instruments and aides the administration concerning whether their activities are reliable with the target of riches augmentation of investors.

Key components of a well-working Financial System

Key components of a well-working money related framework are clarified as underneath:

A solid legitimate and administrative condition : Capital market is controlled by SEBI which acts a guard dog of the securities advertise. This has been guaranteed through the death of SEBI Act, Securities Contract Regulation Act and various SEBI standards, guidelines and rules. In like manner currency showcase and outside trade advertise is controlled by RBI and this has been guaranteed through different arrangements of the RBI Act, Foreign Exchange Management Act and so forth. Along these lines, a solid legitimate framework ensures the rights and premiums of speculators and goes about as a most vital component of a sound money related framework.

Stable cash : Money is a vital piece of an economy. Visit variances and devaluations in the estimation of cash lead to monetary emergencies and limit the financial development.

Sound open accounts and open obligation the board : Sound open funds implies setting and controlling open consumptions and increment incomes to subsidize these uses productively. Open obligation the executives is the way toward building up and executing a technique for dealing with the administration's obligation so as to raise the required measure of subsidizing. It additionally incorporates creating and keeping up a productive market for government securities.

A national bank : A national bank oversees and manages the activities of the financial framework. It goes about as a broker to the banks and government, administrator of currency advertise and remote trade showcase and furthermore moneylender of the final hotel. The financial arrangement of the Central Bank is utilized to keep the pace of monetary development on a higher way.

Sound financial framework : A well-working monetary framework must have expansive assortment of banks both in the private and open segment having both local and global tasks with a capacity to withstand unfavorable national and worldwide occasions. They perform shifted capacities, for example, working the installment and clearing framework, and remote trade advertise. Banks additionally embrace credit hazard examination and survey the normal hazard and return of a task before giving any advance for a proposed venture.

Information System : All the members in the monetary framework requires data at some stage or the other. Appropriate data revelation rehearses structure premise of a sound budgetary framework for example the corporates needs to reveal their monetary execution in the budget reports. Essentially, at the season of first sale of stock, the organizations need to uncover a large group of data unveiling their budgetary wellbeing and proficiency.

Well working securities advertise : A securities showcase encourages the issuance of both value and obligation. A productive securities showcase helps in the organization of assets raised through the capital market to the required segments of the economy, bringing down the expense of capital for the organizations, upgrading liquidity and pulling in remote speculation.

Now dream come true with trusted online test series to crack your CA 2019 exam. Our high quality and most experienced test series will help you to achieve good scores in CA final and CA inter nov 2019 exams. Our series have high success rate, 1200+ questions with 24x7 support at a reasonable price.

So register for online test series for CA Final now and get upto 50% with our all test series. To register yourself visit CA Test Series website or WhatsApp on +91 7888634515, and Call on +91 9988483167.

Must Read: Budgetary Instruments and its attributes

Comments

Post a Comment